Summary

This proposal aims to whitelist the kpk ETH Prime vault as a curated vault on Ethereum.

The vault allocates ETH across selected Morpho markets under kpk-defined risk parameters, combining conservative allocation design with in-house automation and continuous monitoring.

The goal is to offer a low-risk, real-yield ETH strategy that benefits from kpk’s institutional treasury-management expertise and Morpho’s isolated-market architecture.

Overview

kpk, the leading on-chain treasury manager, is bringing its curatorship activities to Morpho.

kpk’s curation framework prioritises robust risk management, capital preservation, and stable returns, while leveraging advanced automation to enhance efficiency and responsiveness

Each kpk-curated vault is built on the following principles:

- Conservative strategy design: targeting sustainable yield from reputable, battle-tested markets.

- Rigorous due diligence: thorough assessment of each integrated asset and collateral.

- Risk-tiered allocation: exposure caps per market, with utilisation and liquidity buffers.

- Automated agents: trigger protective or optimising actions in response to real-time conditions.

- Continuous monitoring: 24/7 oversight with clear escalation and intervention procedures.

- Aligned incentives: reward campaigns complement sustainable yield — never replace it.

kpk WETH Prime

The kpkWETH Prime vault is a non-custodial ERC-4626 vault that lends ETH across selected Morpho markets under curator-defined risk parameters.

Yield comes from lending rates in underlying borrower markets, dynamically rebalanced to maintain target utilisation and liquidity conditions. Automation ensures that capital remains productive while preserving full withdrawal capacity even during market stress.

Documentation: kpk Handbook – Morpho WETH

Automation

kpk vaults integrate a multi-agent automation system that enhances both yield performance and capital safety.

- Rebalancing Agent: actively redistributes exposure across markets to maximise efficiency and maintain target utilisation ranges.

- Exit Agent: monitors liquidity and utilisation in real time, executing timely exits from high-utilisation or deteriorating markets.

In our analysis, automated execution consistently delivers higher realised yields, demonstrating that speed and discipline directly translate into stronger performance.

Market Exposure

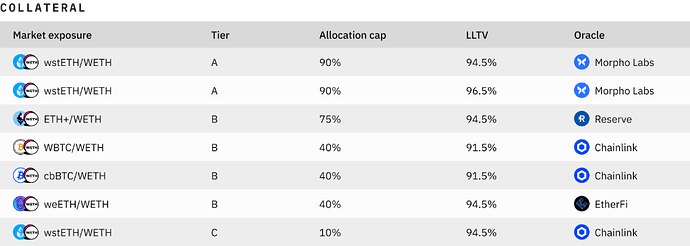

The kpk ETH Prime vault deploys capital across a curated mix of Morpho markets, selected for their liquidity depth, collateral reliability, and risk-adjusted yield potential.

Each market is continuously monitored and dynamically rebalanced by kpk’s automation system to maintain optimal utilisation and liquidity conditions.

Together, these positions form a diversified, low-risk portfolio that captures real on-chain lending yield while maintaining capital efficiency and safety through automation and disciplined exposure management.